virginia state ev tax credit

The final legislation that Biden signed into law also contains a first-ever 4000 federal tax credit for the purchase of used EVs. Get the details on the credit available for the vehicle youre considering.

Pin De Tbueno Curador En There S No Place Like Home

This incentive covers 30 of the cost with a maximum credit of.

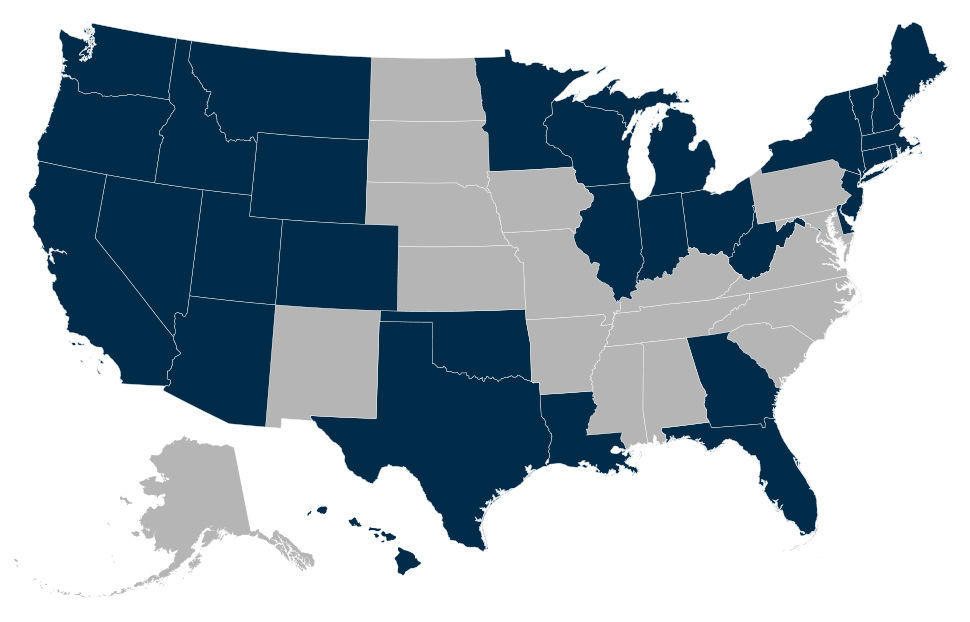

. Get a federal tax credit of up to 7500 for purchasing an all-electric or plug-in hybrid vehicle. Tax credit of 30 of value of used EV with 4000 cap Page 387 line 23. Current EV registrations in the US sorted by state.

And any trucks or SUVs with sticker prices above 80000 or. Massachusetts for instance offers its MassEVIP Workplace and Fleet Charging program which covers 60 of the costs of EV charging equipment and installation for up to 50000 per business address. The minimum credit amount is 2500 and the credit may be up to 7500 based on each vehicles traction battery capacity and the gross vehicle weight rating.

Joe Manchin who negotiated the final bill with Democratic leaders in Congress said he isnt a fan of providing tax credits for EV purchases but wanted to build a strong domestic supply chain. However foreign automakers can still take advantage of the 7500 EV tax credit. Used vehicle must be at least two model years old at time of sale.

Carmakers Blitz Congress to Fix EV Tax Credit They Cant Use The bill is the product of more than a year of negotiations and changing it at this point is unlikely. SRP and APS offer reduced electricity rates based on time-of-use charging for EV owners. Beginning on January 1 2022 you can get a 2500 EV rebate in the state of Virginia on new electric vehicle.

My organization Name of Company is interested in investing in. Any foreign vehicle that is an electric vehicle is going to be able to claim a 7500 credit under existing law. A tax credit is available for the purchase of a new qualified PEVs.

The tax credit would be available only to couples with incomes of 300000 or less or single people with income of 150000 or less. The sortable tables below includes sales of electric vehicles PHEV and BEV and the total EV market share percent of EVs sold of total light vehicles sold within each state for all 50 US states and Washington DC. According to the Canadian government the previous US.

How the data was gathered. Proposal amounted to a 34-per-cent tariff on EVs assembled in Canada and violated the terms of the United States-Mexico. The federal government also offers drivers a variety of rebate programs that can be used to offset part of the costs to purchase residential EV chargersAs of February 2022 residents in any state can get an income tax credit to help defray the cost of both EV chargers and EV charger installations.

Top three states with the most registered EVs as of 123121. Stabenow who called the provision a serious concern said the EV tax credit worth billions of dollars wouldnt be usable for years. The credit varies depending on the vehicle make and battery size.

Most important for the Canadian auto industry there are incentives for buying EVs including a 4000 tax credit for the purchase of used EVs and 7500 for new ones. An extension of the popular 7500 tax credit available to EV buyers was included in the surprise breakthrough deal reached by Senator Joe Manchin and Senate Majority Leader Chuck Schumer last week. West Virginia Democratic Sen.

On top of that federal tax credit there are myriad state and local options available through government entities and utility companies. Moreover it places strict regulations on the cars battery material sourcing to make the entire car qualify. However for all of the simple and mostly good changes to the existing US.

Page 389 line 7. The out-of-pocket cost for the new vehicle is 9000 after trade-in. For the year 2019.

Foreign automakers in. Tucson Electric Power offers a rebate of up to 300 as a bill credit for residential charger installation. Looking for BEV PHEV hybrid and fuel cell vehicle sales by state for the years 2001-2020.

Vehicles received as gifts are exempted from state sales tax. Senator Manchins WVa new Inflation Reduction Act IRA dedicates hundreds of millions of dollars to addressing climate change including tax credits for new and used electric vehicles EVs. Up to 1000 state tax credit Local and Utility Incentives.

Will be eligible for the tax credit. Unfortunately the tax credits are practically useless and will do little if anything to help boost the EV market and decrease emissions. Virginia EV Rebates Incentives.

The bill further aims to encourage domestic EV production by requiring the domestic acquisition of key components in order to get the subsidy. Just purchase or lease and apply with your taxes. Reduced Vehicle License Tax and carpool lane access.

1 in 3 Americans Live in State with 100 Clean Electricity Commitment. FILE - An electric car charging station is positioned outside the Science Museum where Virginia State Senators are meeting for their 2021 legislative session in. Up to 7500 Back for Driving an EV.

- A new federal tax credit of 4000 for used EVs - Zero-emission vans SUVs and trucks with MSRPs up to 80000 qualify - Electric sedans priced up to 55000 MSRP qualify - The full EV tax credit will be available to individuals reporting adjusted gross incomes of 150000 or less 300000 for joint filers. You trade in your old vehicle and receive a 6000 credit. Manchin who walked away from a more expansive tax-and-spending bill in December has railed against the 7500 vehicle tax credit for months and even dismissed it as.

The auto industry is still processing the new and confusing electric vehicle credits signed into law by President Joe Biden as part of the Inflation Reduction Act of 2022. EV Federal Tax Credits. Although the United Auto Workers pushed for a special EV credit for vehicles built in plants with union workers which didnt make the final version organized labor did influence key provisions written into the new law thanks to the support of Senator Joe Manchin D-West Virginia whose longtime links to organized labor were often overlooked during the final push.

Only EVs manufactured in the US. Electric Vehicles Solar and Energy Storage. Table of contents.

9 Hidden Costs That Come With Buying A Home Buying First Home Buying Your First Home First Home Buyer

Which Evs Qualify For New Us Tax Credit Websites Offer Help The Seattle Times

Democrats At Odds Over Ev Tax Credit In Manchin Schumer Bill Bloomberg

The Federal Geothermal Tax Credit Your Questions Answered

Federal Rehabilitation Investment Tax Credit American Architecture Architecture 18 Century House

Senate Push For Expansive Electric Vehicle Incentives Could Hit Bumps The Seattle Times

Learn The Steps To Claim Your Electric Vehicle Tax Credit

Maryland Map Maryland Greetings

12 500 Ev Incentive Plan Headed To Senate As Part Of Bbb Act Forbes Wheels

Everything You Need To Know About The Solar Tax Credit

Electric Vehicle Incentives By State Polaris Commercial

7 500 Federal Ev Tax Credit Jeep Wrangler 4xe Forum

Crowning An Energy Champion Among U S Colleges Universities March Madness Style Chester Energy An Colleges And Universities March Madness Systems Biology